In the digital age, data and information are at the core of our daily lives. The way we store, share, and secure these digital assets is evolving, and one technology stands out as a beacon of innovation: blockchain. In this article, we will delve deep into the world of blockchain, exploring its origins, fundamental principles, and diverse applications.

The Genesis of Blockchain

The concept of blockchain emerged in 2008 when an anonymous entity known as Satoshi Nakamoto introduced Bitcoin, a digital currency that relied on a revolutionary technology called blockchain. But what is a blockchain, and how does it work?

Understanding the Blockchain

A blockchain is a distributed ledger that records transactions across multiple computers in a way that ensures security, transparency, and immutability. Let’s break down its key components:

- Decentralization: Unlike traditional centralized systems, blockchain operates on a decentralized network of computers (nodes). This means no single entity has control, making it resistant to censorship and tampering.

- Blocks and Transactions: Information is grouped into blocks, which contain a list of transactions. Once a block is full, it’s cryptographically linked to the previous one, forming a chain. This chain of blocks is the essence of the term “blockchain.”

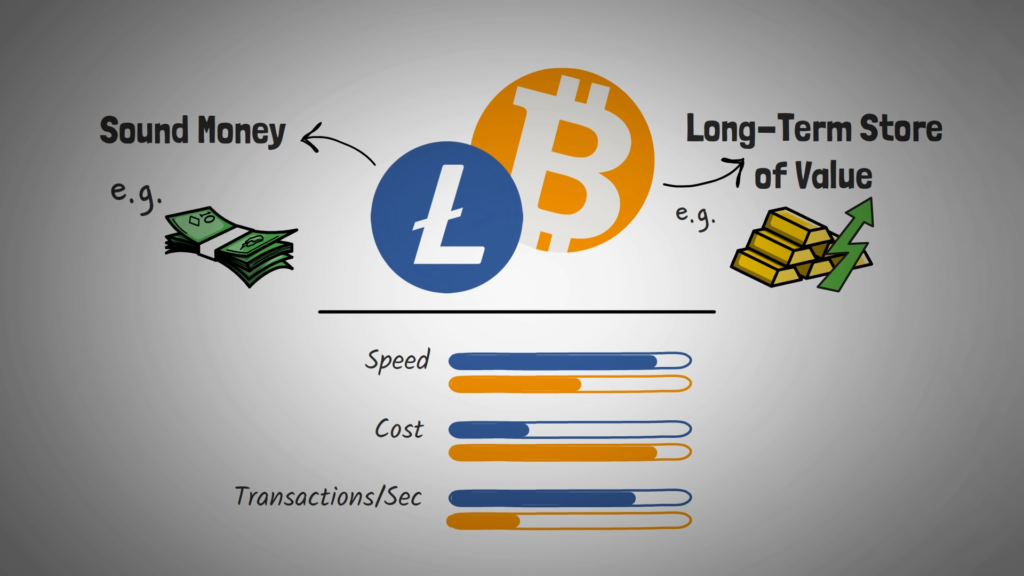

- Consensus Mechanisms: To validate and add new blocks to the chain, blockchain networks use consensus mechanisms. The most famous is Proof of Work (PoW), where miners compete to solve complex mathematical puzzles. Newer blockchains like Ethereum use Proof of Stake (PoS), where validators are chosen based on the amount of cryptocurrency they hold and are willing to “stake.”

- Security and Immutability: Once a transaction is recorded on the blockchain, it’s nearly impossible to change or delete. This immutability is a core feature, ensuring the trustworthiness of the data.

Applications of Blockchain

Beyond cryptocurrencies, the potential applications of blockchain technology are vast and continually expanding:

- Supply Chain Management: Blockchain can provide transparency and traceability in supply chains, ensuring the authenticity and origin of products.

- Smart Contracts: Self-executing contracts that automatically enforce and verify the terms of an agreement without intermediaries, reducing costs and increasing efficiency.

- Voting Systems: Secure, transparent, and tamper-proof voting systems can improve the integrity of elections.

- Healthcare: Patient records can be securely stored and accessed, enhancing patient care and data privacy.

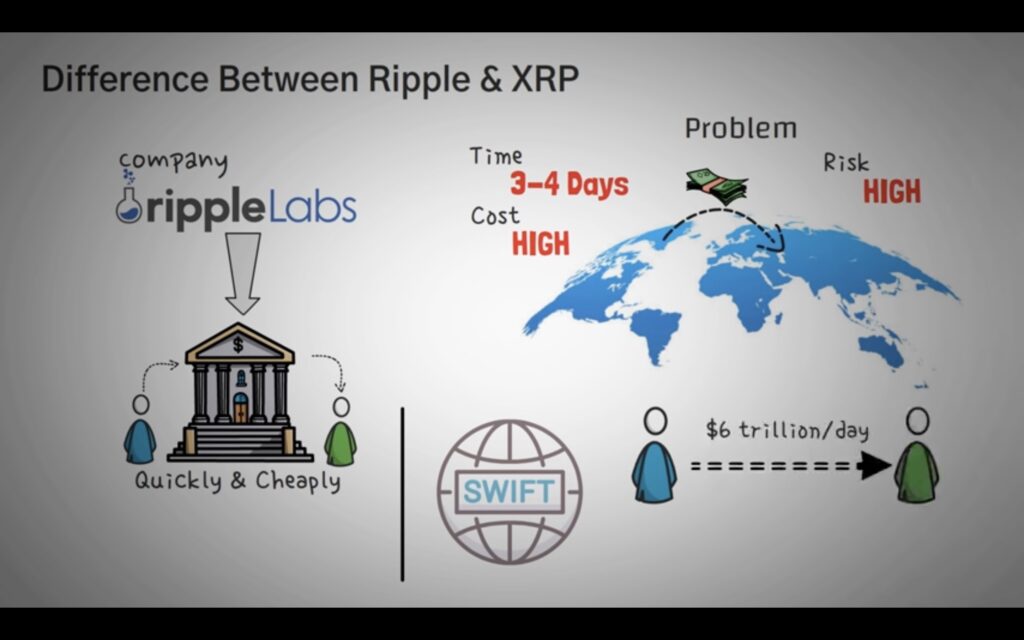

- Finance: Blockchain can revolutionize banking, cross-border payments, and lending by making transactions faster, cheaper, and more secure.

- Identity Verification: Individuals can have control over their digital identities, improving security and privacy.

- Intellectual Property: Blockchain can protect copyrights and intellectual property rights by timestamping and verifying content ownership.

- Energy Trading: Peer-to-peer energy trading is made possible through blockchain, allowing individuals to buy and sell excess energy directly.

Challenges and Future Prospects

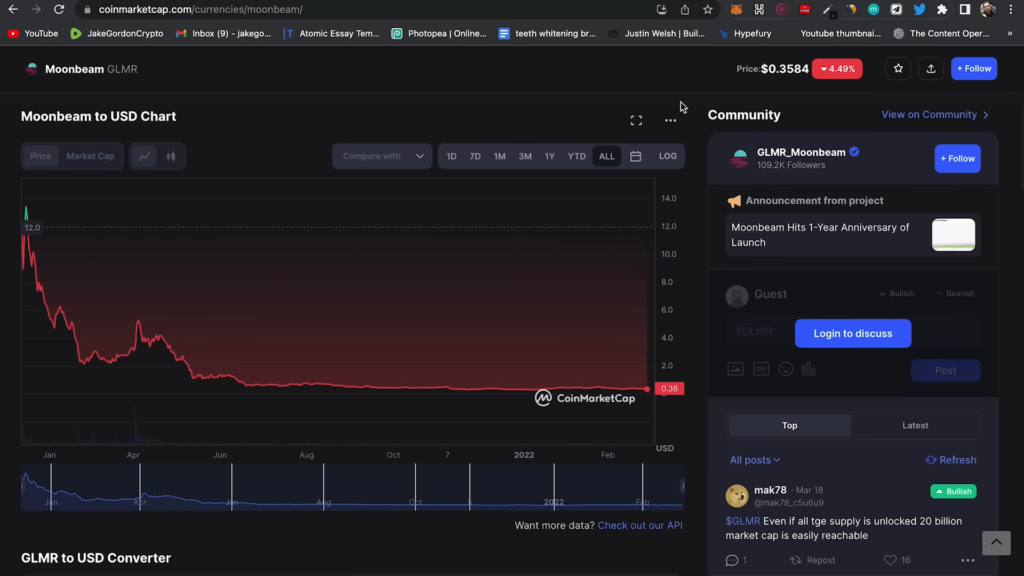

Despite its immense potential, blockchain faces several challenges, including scalability, energy consumption (in PoW systems), and regulatory hurdles. However, ongoing research and development are addressing these issues, paving the way for a future where blockchain could become an integral part of our digital infrastructure.

Blockchain technology represents a monumental shift in how we handle data, trust, and digital assets. From its humble beginnings with Bitcoin to its diverse applications across industries, the impact of blockchain is undeniable. As we continue to explore its capabilities and work through challenges, the potential for blockchain to revolutionize our world is nothing short of extraordinary. It’s a technology that holds the promise of a more secure, transparent, and decentralized future. So, keep an eye on blockchain; it might just be the key to a digital revolution we’ve all been waiting for.